Posts by First Pacific Financial

2017 Saving Limits on Retirement Plans

With 2017 well on its way, it’s a good idea to review and update your savings goals for the year. The 401k contribution limit has remained unchanged at $18,000, with a $6,000 catch up contribution available for participants over age 50. IRA contribution limits are also the same as 2016 but the amount of income…

Read MoreInflation

Knowing that we’ll need more money to buy the same amount of goods we are buying today can be daunting. This is the reason savers choose to invest, so as to keep the purchasing power of their hard earned dollars ahead of inflation.

Read MoreFlexible Spending in Retirement

By adjusting spending accordingly, you are not required to live an austere lifestyle early on, because you can adjust your spending to meet the needs of the portfolio as time goes on. This flexibility can potentially increase the sustainable percentage distributed from a retiree’s portfolio. We recommend you read the full article here. Keep in mind there is no “one size fits all” approach to investing. We recommend creating a living plan which addresses your specific goals and needs, tailored to your unique circumstances.

Read MoreCoffee Group Hits Ground Running

Our monthly Coffee Group has been a huge success as clients have been able to meet and greet other advisors and First Pacific staff.

Read MoreCell Phones: Best Bang for Your Buck

Comparing cell phone plans can be difficult. With hidden fees, alternative coverage areas, and differing data, text, and phone options, it can feel almost impossible to choose which plan is right for your family. Like with many financial decisions, it helps to begin with the end in mind.

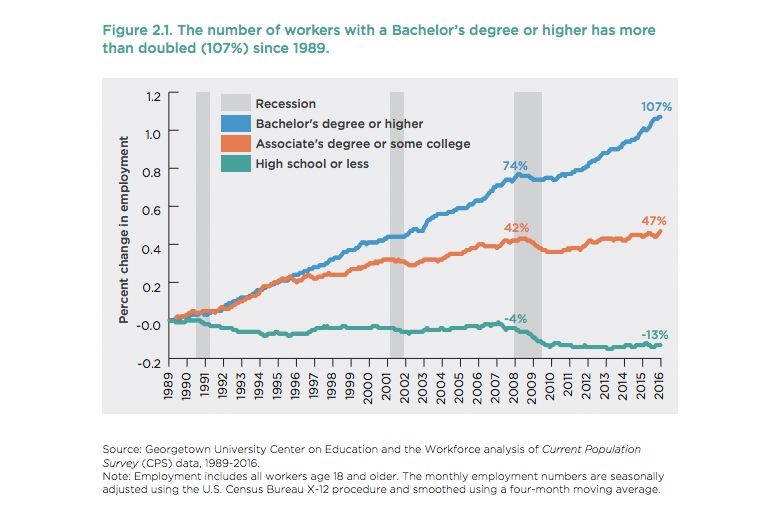

Read MoreAmerica’s Divided Recovery

With a growing chorus of college grads bringing their student loan woes to the forefront of this election cycle, many have questioned the value of a college education. Georgetown University’s Center on Education and the Workforce recently put out a striking report that depicts the growth in the labor market since the Great Recession. Workers with an Associate’s degree or even some college have fared far better in the workforce adding 3.1 million jobs versus those with only a high school diploma who have added a meager 80,000 jobs. Workers with a Bachelor’s Degree or higher? They’ve added 8.4 million jobs.

Read MoreSavings for the Grandkids’ College Education

According to U.S News and World Report, in a recent survey, more than 50% of grandparents are saving or plan to start saving for grandchildren’s college expenses. Most of them chose to save into a 529 college savings plan that provides tax deferred growth and tax free withdrawal for education purposes. 529 college savings plans are free from federal income taxes until the money is withdrawn for qualified educational spending.

Read MoreWhy Oil Prices Fluctuate

The main reason they fluctuate is supply and demand. But this is not the only reason.

Read MoreProtect Thyself from Thyself: Investor Biases

Over an investor’s lifetime, there is likely to be many opportunities to fall victim to one or more of the biases Pfau outlines. Even the most successful investors can fall into these behavioral missteps without a trained and experienced advisor watching out for us.

Read MoreTax Savvy Giving

At First Pacific Financial, we often evaluate these types of strategies for our clients. There can be many factors to consider in your individual situation and these should be carefully understood and evaluated before making this a long term strategy.

Read More