Oct 15, 2012

Buying vs. Renting

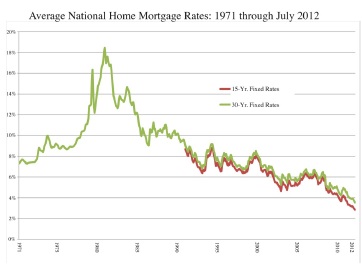

For people of a certain age who remember taking out a home mortgage at 15% to 18%, the astonishingly low rates that banks are charging today are a little hard to believe. The chart below, taken from statistics collected by the Federal Home Loan Mortgage Corporation for 15-year and 30-year fixed-rate mortgages, tells the story: rates have been historically low for years, and they have been trending lower ever since the bottom fell out of the real estate market.

This has created a strange, but not unusual market situation. People who remember the housing market collapse are nervous about buying, right at the time when they can buy more house for less money than ever before in their lifetimes. Not only that, but today we can finance at lower mortgage rates than we may ever see again. Unfortunately, our instincts tell us to buy when the markets are booming and prices are high, and to stay on the sidelines when the markets are offering us bargains.

The economic case for purchasing a home versus renting has always been a bit unclear. The real estate website Trulia has calculated that the breakeven between buying and renting comes when you can buy for 15 times your yearly rental costs. By that formula, if you’re paying $20,000 a year in rent, you might think twice about purchasing a compa-rable home that costs more than $300,000. But that formula has some embedded assumptions about mortgage rates. If you were to buy that $300,000 house and finance it at 18.45% (the average national mortgage rate back in October 1981), then your $4,631 monthly payments would amount to $55,572 a year, which is more than two and a half times the rental rate you’re paying now. This might not be the ideal tradeoff, but at 3.55% (the average national rate in July) the payments are $1,355 a month, or $16,260. At those rates, even if you factor in maintenance and property taxes, buying might actually cost less per month than renting.

Trulia identifies markets where prices are historically high and historically low. The average two-bedroom condominium or townhouse in the New York City area currently costs about 32 times as much to buy as to rent. In Seattle, you can expect to buy at about 24 times the rental cost; San Francisco and Portland, OR now cost 22 times as much. At the same time, Miami homes are going for about about eight times annual rents, while Phoenix (10 times) and Las Vegas (11 times) seem to be relative bargains.

In general, you should avoid committing too much of your cash flow to the place you live; annual housing costs should be less than a third of your gross annual income and you probably shouldn’t count on your home appreciating in value immediately. A recent report by Fitch Investors Services says that in many markets, housing prices won’t have completely bottomed out until late next year. This is not a market for flipping homes, but with the combination of low rates and distressed prices, it may be one of the best times to buy that many of us have seen in a long time.