Jun 2, 2016

Protect Thyself from Thyself: Investor Biases

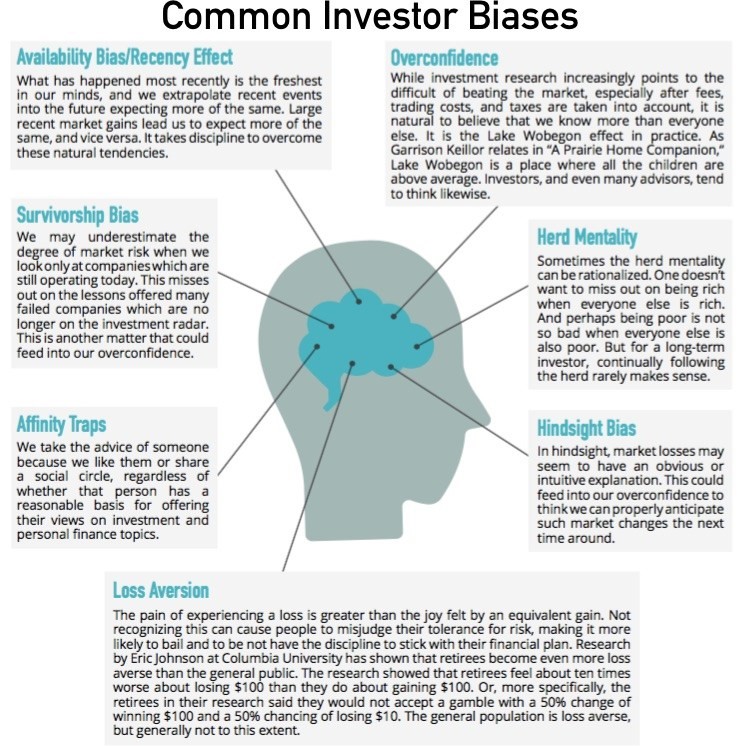

Wade Pfau, Ph.D., CFA recently posted a great article detailing common investment biases that get investors into trouble. Some of the biases he lists are:

- Availability Bias

- Overconfidence

- Herd Mentality

- Hindsight Bias

- Loss Aversion

- Affinity Traps

- Survivorship Bias

Controlling our own behaviors can be difficult. Not getting overly depressed when investments are down, or overly excited when things are going well is the best way of keeping ourselves prudently invested for the long term. We firmly believe that a financial advisor’s role is to be a behavioral investment counselor. Over an investor’s lifetime, there is likely to be many opportunities to fall victim to one or more of the biases Pfau outlines. Even the most successful investors can fall into these behavioral missteps without a trained and experienced advisor watching out for us.