Jul 8, 2016

America’s Divided Recovery

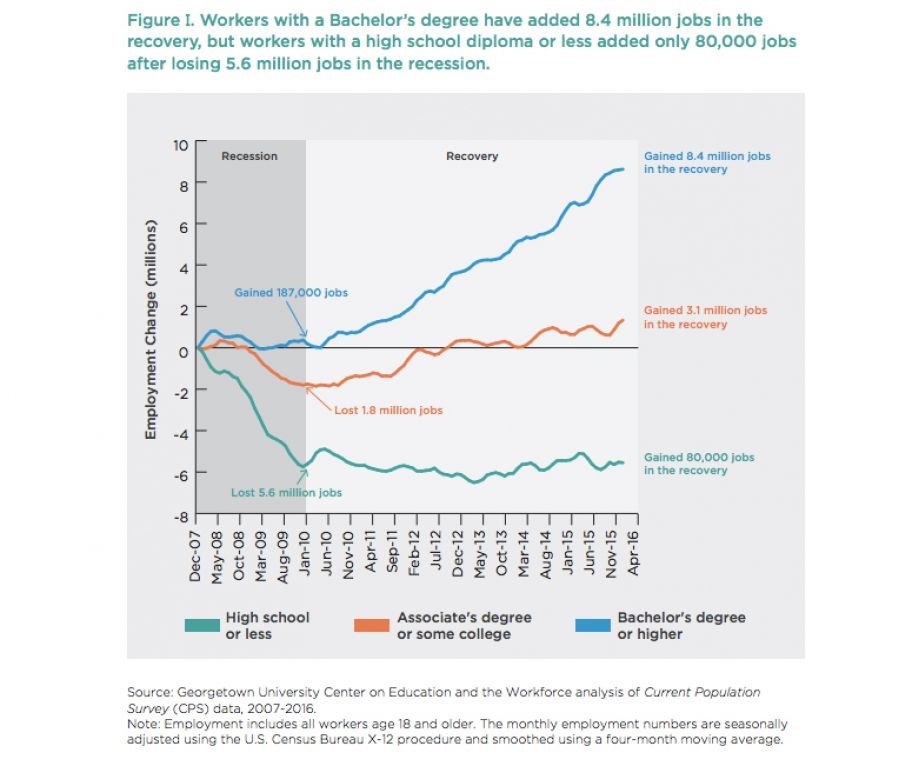

With a growing chorus of college grads bringing their student loan woes to the forefront of this election cycle, many have questioned the value of a college education. Georgetown University’s Center on Education and the Workforce recently put out a striking report that depicts the growth in the labor market since the Great Recession. Workers with an Associate’s degree or even some college have fared far better in the workforce adding 3.1 million jobs versus those with only a high school diploma who have added a meager 80,000 jobs. Workers with a Bachelor’s Degree or higher? They’ve added 8.4 million jobs.

For parents wanting to ensure their children are set up to succeed, it makes planning for a post high school education all the more necessary. College or University, technical college, or a myriad of other skills can be taught to increase the value of their children’s contributions to the economy. Helping to pay for this education can be daunting but not impossible with the right tools.

Tips for getting started:

- Start saving from birth

- Save in tax efficient accounts to compound the growth of savings by eliminating tax drag

- Effectively use Grandparent Funded 529 accounts to avoid reporting the assets on a Free Application for Federal Student Aid.

These are all tips to share with any new parents. It can one day be the difference between their adult children coming to visit as oppose to living with them into their retirement.