Jul 16, 2013

Retirement Planning : Social Security Optimization

Retirement age has finally come for many within the baby boom generation. Whether that be a young boomer retiring early at 58, a 62 year old retiring simply because she is finally eligible for Social Security, a 66 year old “hanging it up” because he is eligible for his work pension, or a 69 year old who is simply ready to call it quits. All of these retirees have a very important decision to make, and a decision that many are making without enough thought. That is: when to start Social Security benefits?

Contrary to what many believe, retirement age and Social Security age should not always be the same. Especially when retirees are married or widowed, the age to start Social Security income is complex. Many factors must be considered, and you run the risk of potentially leaving $100,000 to $200,000 on the table.

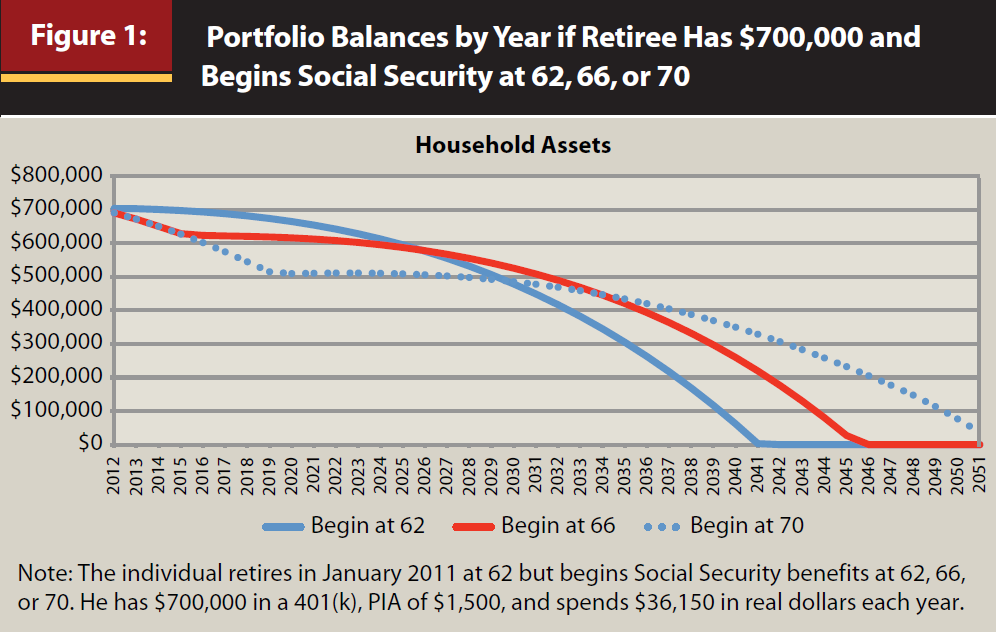

Delaying Social Security after reaching the first age eligible, 62, has significant benefits if the retiree simply lives until life expectancy. Delaying past full retirement age of 66 or 67 up until age 70 can significantly affect portfolio longevity (age at which portfolio is fully spent). The graph below is taken from a study titled “How the Social Security Claiming Decision Affects Portfolio Longevity” by William Meyer and William Reichenstein, Ph.D., CFA. It shows a sample retiree with a portfolio of $700,000 and drawing Social Security income at different ages.

The important takeaway is the advantage of drawing Social Security at age 62 versus waiting until age 70 is potentially a 20-year extended portfolio longevity. Living in a period which life expectancy seems to be increasing at such an astonishing rate, it is smart planning to assume that today’s retirees will live well into their 90’s.

Spousal Benefits

The often ignored planning technique with Social Security revolves around spousal benefits. Assuming eligibility, a spouse is entitled to one-half of a worker’s benefits once the spouse reaches full retirement age. Not only that, but there are many situations in which a spouse can draw spousal benefits, then switch to their own benefits at a later age. This strategy can even be used while both spouses are still working.

Example: John and Jane are each entitled to $2,500 per month at 66, but both plan to work until age 70 and wait to draw Social Security. Jane could start spousal benefits at age 66 of $1,250 per month even though she is still working. This is a total of $60,000 over the 4 years!

Run Social Security Optimization with your Advisor

Begin running Social Security Optimization scenarios with your advisor before reaching the age of eligibility. There is too much money on the line to put off planning for Social Security. There are many nuances to be considered in the decision; including portfolio value, health, life expectancy, spousal age gap, benefit amounts, survivor benefits, pension eligibility, and more. The alternative to maximizing your benefits might get you a call from your congressperson thanking you for improving the Social Security Administration’s budget projections.

Source: http://retireeincome.com/research_april2012/jfp_ssportfoliolongevity.pdf